Your employer will deduct emergency tax from your paycheck if you do not provide complete information of tax at the start (of work) within the United Kingdom. In addition, you are also charged with an emergency tax on your pensions. Therefore, read on this blog to know how to avoid emergency tax.

We are skilled chartered accountants in London that provide the best accounting and taxation services at affordable prices!

What is an Emergency Tax?

Emergency tax is charged by HM Revenue & Customs. It is charged when you fail to provide essential information about your tax and income for a year. It is usually applied for the following reasons:

- If you begin a new job and you do not have a P45.

- If you are working for an employer after being a self-employed person.

- If you start receiving company benefits and your state pension while still working.

Your emergency tax code will begin with an M1 or a W1.

How to Know if You are On an Emergency Tax Code?

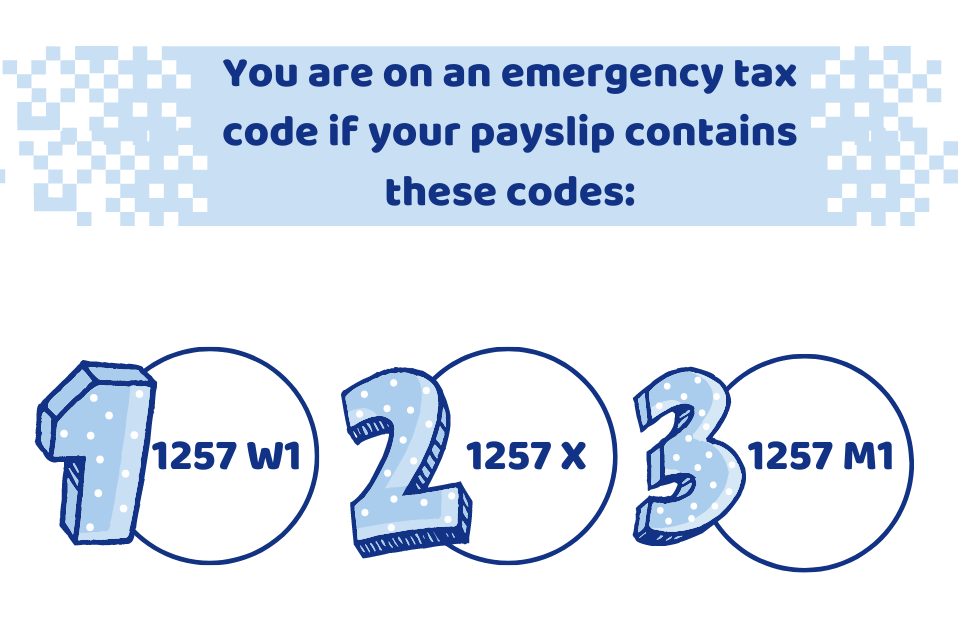

To know this, check your payslips. If your payslip contains any of the following tax codes, then you are charged emergency tax by HMRC.

- 1257 W1

- 1257 X

- 1257 M1

How to Avoid Emergency Tax?

So, how to avoid emergency tax ? Let’s see!

If you are on any of the codes mentioned above, the easiest way to avoid emergency tax is to provide the new employer details of your previous tax payments and income or a P45.

This information will inform about the amount of tax you paid in your last job to the new employer, and it will submit these details to HMRC. After this, a PAYE Coding Notice listing your new tax code will be issued by HM Revenue & Customs. This new tax code will then appear on the next payslip from your employer.

Your employer will need to fill out a Starter Checklist in case you don’t have a P45 (you will not have it if you have a new job). This will assist your employer in assigning you a tax code. Then this tax code will be forwarded to HM Revenue & Customs.

Are you tired of taxation problems? Take your break and let Our Experts handle the rest!

What is the Method to Prevent paying the Emergency Tax?

The amount of emergency tax depends on your emergency code and your earnings. However, it implies that anything above the basic personal allowance (which currently stands at £12,570) will be taxed.

You may be taxed up to 50 percent of your salary under an emergency tax, which is the maximum amount someone can be charged. Therefore, preventing the emergency tax is easier and less stressful. The method to prevent paying the Emergency tax is as follows.

- You can directly contact HM Revenue & Customs in case you have been working within your new employment for three months and are still paying the emergency tax.

- The emergency tax code may imply that you have previously paid too much tax so that the HMRC will issue you a tax rebate in this case.

Quick Sum Up

We hope now you have understood how to avoid emergency tax and the method to prevent paying emergency tax. When you fail to provide the details of income and tax to your new employer, emergency tax is charged by HMRC. However, It is crucial to provide these details to avoid emergency tax. You can also claim back tax that you overpay, but preventing emergency tax is easier.

Are you looking for a qualified accountant to reduce your burden of managing finances? Then, feel free to contact us! We will handle your finances at reasonable charges and grow your business like never before!

Disclaimer: This blog contains general information about emergency tax.